Economic Observer Follow

2026-01-10 18:04

![]()

In the past two months, Yunnan, Anhui, Guizhou, Liaoning and other places have announced that the highest standard for the payment level of basic old-age insurance for urban and rural residents (hereinafter referred to as "farmer's pension") will be raised in 2026, which is another intensive upward trend after several years.

Farmers' pension mainly includes "basic pension+personal account pension". Among them, the basic pension is composed of subsidies from the central and local finances, while the individual account pension mainly comes from personal contributions. From the perspective of institutional design, there is an annual upper limit for individual contributions, which is the highest standard for the payment level of farmers' pension.

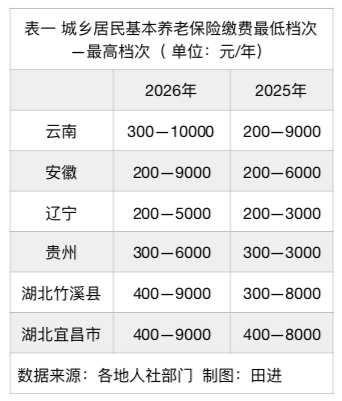

As shown in Table 1, in previous years, the upper limit of pension contributions for farmers in Liaoning and Guizhou was 3000 yuan/year, but in 2026, it will jump to 5000 yuan/year and 6000 yuan/year respectively. Yunnan has further increased to 10000 yuan per year, becoming the first province in China to exceed the payment limit of 10000 yuan. If Yunnan residents continue to pay farmers' pension for 15 years according to the payment limit, according to the latest calculation method, the monthly pension after retirement will exceed 1200 yuan.

In recent years, the issue of low pension levels for farmers has been a concern. In 2023, the average monthly pension for retired employees in enterprises nationwide is 3162 yuan, while the average monthly pension for farmers is 214 yuan, a difference of 14.8 times between the two.

From the perspective of reasons, on the one hand, the government's subsidy for farmers' pensions is limited, and on the other hand, the level of personal contributions is relatively low. Under the principle of "pay more, get more", if an individual pays a 15 year farmer's pension according to the lower limit of payment (set at 200 yuan/year in multiple provinces), even if financial subsidies are added, the pension after retirement is only about 200 yuan/month.

With the implementation of the upper limit of pension contributions for farmers in various regions in the new year, the reasons behind the increase, the profound impact it will have, and how to enjoy policy dividends are still urgent questions that need to be answered for ordinary people.

Associate Professor Qiao Qingmei from the School of Labor and Personnel at Renmin University of China stated that if individuals choose the highest payment level for farmers' pension, it will undoubtedly significantly improve their retirement pension level and better ensure their retirement life. But this requires a direct trade-off between short-term income and long-term security, and most urban and rural residents still prefer to choose lower level payments. The fundamental solution to changing this situation is to increase residents' current and expected income, so that they have surplus funds to prepare for future retirement.

A social security expert who has studied and participated in the reform of the social security system for many years said that the higher the payment level chosen by individuals, the higher the subsidies provided by local governments to individuals. Against the backdrop of financial pressure faced by local governments, it is also a dilemma for them to encourage more people to pay farmers' pensions at higher levels.

Farmers' monthly retirement pension can exceed 1000 yuan

Compared to the basic pension insurance for enterprise employees, the coverage of the rural pension system is wider. According to data from the Ministry of Human Resources and Social Security, as of 2024, a total of 540 million people have participated in the rural pension system, of which 180 million have actually received benefits.

According to the system design, individuals can only participate in the farmers' pension system in the registered residence area, and cannot pay the employees' pension insurance at the same time; After accumulating 15 years of contributions, farmers can receive their pension after retirement. In addition, whether individuals contribute to the farmers' pension follows the principle of voluntary participation, and individuals can also choose freely between the highest and lowest standards of the contribution level.

In recent years, thanks to the continuous increase of basic pension, farmers' pension has been steadily rising. Among them, from 2021 to 2025, the minimum standard for national basic pension will be raised from 93 yuan/month to 143 yuan/month, but there are significant differences in the additional basic pension standards provided by local governments.

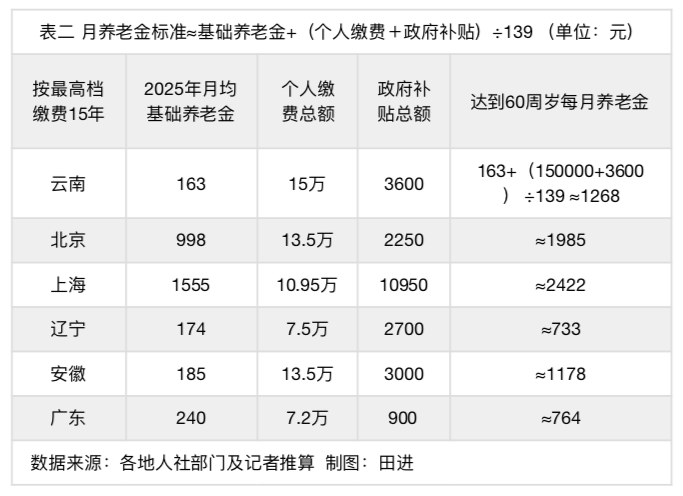

As shown in Table 2, compared to economically developed regions such as Beijing and Shanghai, the basic pension level in most provinces is below 200 yuan per month. In this context, if residents in central and western provinces want to improve their personal farmer pension benefits, they can only do so by increasing their personal contribution levels.

Qiao Qingmei stated that the increase in the upper limit of farmers' pension contributions is closely related to the policy's goal of raising the average level of farmers' pension. Previously, the market generally believed that the level of farmers' pension was low. Considering the pressure of fiscal subsidies, in order to narrow the gap between farmers' pension and enterprise retirees' pension, it is necessary to find a solution from the personal account pension (i.e. personal payment end).

In the past two months, many places have clearly stated that the purpose of raising the upper limit of farmers' pension contributions is to improve the average level of farmers' pension. For example, on December 31, 2025, the Department of Human Resources and Social Security of Anhui Province proposed in the "Notice on Increasing the Highest Payment Grade of Basic Pension Insurance for Urban and Rural Residents" that this adjustment is to adapt to the trend of continuous income growth of urban and rural residents in Anhui Province, broaden the independent choice space of insured persons, and encourage insured people to improve their future pension level through multiple and long-term payments.

According to incomplete statistics from the Economic Observer, after this round of adjustment, the upper limit of farmers' pension contributions in most provinces, including Beijing, Hunan, and Zhejiang, is between 6000 and 9000 yuan per year; Some provinces such as Gansu and Liaoning still maintain a rate of 5000 yuan per year; At present, the maximum payment limit for farmers' pension in Yunnan is 10000 yuan per year.

The total amount of personal account pension is composed of "personal contributions+government subsidies+interest generated from personal accounts". Therefore, as shown in Table 2, the farmer's pension for the first month after retirement for residents in various regions can be directly estimated. It should be noted that if both personal account interest and the annual increase in basic pension are taken into account, the actual farmer pension received by individuals will inevitably be higher than the estimated data in the table.

As shown in Table 2, if individuals start paying the upper limit of farmers' pension for 15 years from 2026, the monthly pension for farmers in Beijing and Shanghai can reach at least 1985 yuan/month and 2422 yuan/month, and Yunnan and Anhui can also exceed 1000 yuan/month.

Xiang Yunhua, a professor at the Social Security Research Center of Wuhan University, said that through the mechanism of "paying more for more", paying more at a higher level can improve the future pension level of individuals, thus enhancing the economic security ability of residents in their old age, while narrowing the treatment gap between farmers' pension and employees' pension insurance, and promoting institutional fairness. In addition, increasing payment can also increase the size of the fund pool, enhance the investment and operation capabilities of the fund, and strengthen the long-term solvency of the system.

It is worth noting that even if an individual is approaching retirement and has not previously paid the farmer's pension, they can still make a one-time payment of 15 years of farmer's pension. According to this calculation, if a resident of Yunnan can make a one-time payment of 150000 yuan according to the latest payment limit when approaching retirement, their monthly pension can be directly increased to over 1200 yuan/month after retirement.

Xiang Yunhua said that after raising the pension payment level of farmers in many places, some insured people with better economic conditions who are nearing retirement may choose to raise the payment level in the final stage to improve pension benefits.

Xue Huiyuan, Deputy Director of the Social Security Research Center at Wuhan University, said that raising the payment level can expand the choice of payment options, allowing middle and high-income residents to have insurance coverage levels that are suitable for their own abilities, and avoiding the situation of "wanting to pay but unable to pay" due to a too low upper limit.

Why raise the maximum payment standard

In recent years, the policy level has repeatedly mentioned the need to adjust the payment level of farmers' pension.

In 2018, the Ministry of Human Resources and Social Security issued Document No. 21, proposing that localities should reasonably determine and adjust the payment level standards for basic pension insurance for urban and rural residents based on their income growth, for urban and rural residents to choose from. In June 2025, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council issued the "Opinions on Further Ensuring and Improving People's Livelihood and Focusing on Solving the Urgent Difficulties and Worries of the Masses", proposing to optimize the setting of payment levels for basic old-age insurance for urban and rural residents, reasonably determine the level of payment subsidies, appropriately increase payment flexibility, and improve the incentive mechanism of "more payment, more reward".

Xiang Yunhua said that the recent increase in the upper limit of farmers' pension contributions in many places is not only in response to the policy orientation, but also in response to the income growth needs of the people in the context of aging.

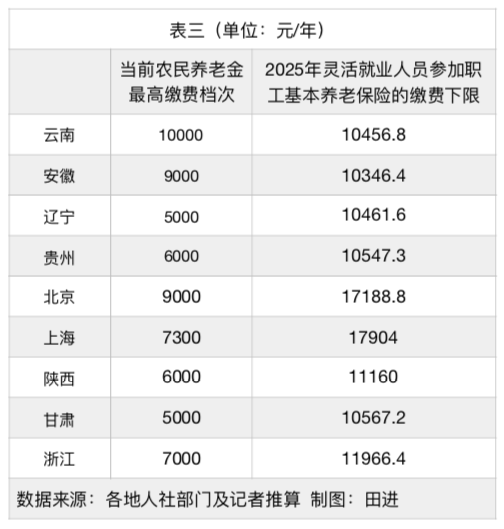

According to the system design, the maximum annual contribution limit for farmers' pension should not exceed the annual contribution amount of flexible employment personnel participating in the basic pension insurance for employees in the province (city). In the past five years, the lower limit of the social security contribution base for employees in many regions has seen a relatively high increase. By 2025, the minimum annual contribution for flexible employees in the vast majority of provinces who choose to pay basic endowment insurance for employees has risen to over 10000 yuan, while in Beijing and Shanghai it is over 17000 yuan (see Table 3).

In this context, Yunnan, Anhui, Guizhou and other places have recently chosen to raise the maximum contribution level of farmers' pension, further aligning the standard with the upper limit set by the system. For example, Yunnan has raised the upper limit of farmers' pension contributions to 10000 yuan, which is very close to the institutional limit (10456.8 yuan).

In June 2023, Yunnan once raised the upper limit of farmers' pension contributions (from 3000 yuan to 9000 yuan). At that time, the relevant person in charge of the Yunnan Provincial Department of Human Resources and Social Security interpreted that the high-end payment standards for urban and rural residents had been added, and the highest payment standard for basic pension insurance for urban and rural residents had been linked with the minimum annual payment standard for flexible employment personnel participating in enterprise employee basic pension insurance, which could meet the payment needs of urban and rural residents with different income levels; By guiding insured individuals to choose higher-level payment standards, gradually increasing the accumulation of personal account funds, and improving the level of pension benefits.

Xiang Yunhua said that optimizing the payment grade and forming a gradient structure in the payment standards of the two systems of farmers' pension and workers' pension insurance would help some flexible employees and migrant workers to move freely between the two systems, and would further narrow the average treatment gap between the two systems.

However, a noteworthy data point is that, as shown in Table 3, the highest payment level for farmers' pension in provinces such as Zhejiang, Gansu, and Liaoning is still far below the upper limit set by the system.

Xue Huiyuan stated that although multiple payment levels have been set for farmers' pension, the payment levels have not been adjusted for many years and cannot reflect the actual income growth of urban and rural residents. In the past few years, the per capita disposable income of urban and rural residents has continued to grow. In order to meet the higher retirement savings needs of residents, especially middle and high-income residents, it is necessary to timely raise the upper limit of urban and rural residents' social security contributions. Secondly, many regions in China have not adjusted the payment levels of farmers' pension for many years, which can easily lead to the dilemma of "a large number of insured people, low payment levels, and low treatment levels". Appropriately raising the upper limit of payment levels can not only broaden payment options, but also improve the future pension level of insured residents.

Against this background, Xiang Yunhua said that in the future, more provinces will follow up and raise the highest payment level with great probability. The Ministry of Human Resources and Social Security requires that the highest payment level should not exceed the annual contribution amount of local flexible employment personnel participating in employee pension insurance. Therefore, there is still room for upward adjustment in most regions.

Most residents still choose to pay at a lower level

In interviews, multiple social security experts coincidentally mentioned that although the upper limit of pension contributions for farmers in various regions continues to rise, in practice, most residents still prefer to choose lower end contributions rather than the highest end.

Previously, the average contribution level of farmers' pension announced by multiple regions also confirmed the views of Xiang Yunhua and Qiao Qingmei.

For example, as of the end of August 2025, the per capita contribution level of rural pension in Wuwei City, Anhui Province was about 1151.91 yuan, and by the end of 2024 it was 813.31 yuan. In 2025, the contribution level of rural pension in Anhui Province was between 200-6000 yuan; In Shexian County, Anhui Province, approximately 67300 taxpayers will choose to pay 500 yuan or more in 2025, compared to about 120000 insured and paying in Shexian County in 2024.

In November 2024, the Law Enforcement Inspection Group of the Standing Committee of the National People's Congress released a report on inspecting the implementation of the Social Insurance Law of the People's Republic of China. It was mentioned that in terms of tiered payment for residents' pension insurance, the law enforcement inspection group conducted a sampling inspection in rural areas and found that about 80% of villagers chose the lowest level of payment.

For individuals, if they want to obtain higher retirement benefits by paying the farmer's pension according to the payment limit, they must sacrifice a portion of their income every month in exchange for retirement pension benefits. Qiao Qingmei said that choosing a higher level of payment will significantly affect current income, and individuals usually tend to choose a lower level of payment.

Taking Yunnan as an example, if the latest payment limit is used to pay farmers' pension, individuals need to spend about 833 yuan per month. In 2024, the per capita disposable income of rural residents in Yunnan will be 17450 yuan (approximately 1454.2 yuan/month).

In the view of Xiang Yunhua, there may not be a large-scale shift of residents from paying the lowest level to paying the highest level in the short term. Firstly, the payment ability of the insured population is limited; Secondly, residents' perception of the long-term return rate of farmers' pension is not obvious, and the policy incentives (subsidies) are limited, so raising the payment level is not attractive to residents.

Xiang Yunhua said that the key to promoting more residents to take the initiative to raise their payment levels is to improve their economic ability and the government departments should appropriately increase subsidies and incentives for high-end payment groups. Currently, the majority of insured individuals choose to pay at a lower level due to the low payment pressure and the fact that meeting the minimum insurance requirements allows them to enjoy basic pension benefits.

In recent years, promoting personal income growth has been put on the agenda at the policy level. The Central Economic Work Conference held on December 10-11, 2025 mentioned the formulation and implementation of plans to increase the income of urban and rural residents. Previously, a series of measures to promote income growth have been introduced one after another. For example, in 2025, Beijing, Hunan, Shanghai, Guangxi and other places will gradually raise the minimum wage standards; Overall, the first tier of monthly minimum wage standards in 31 provinces exceeds 2000 yuan, with Beijing, Shanghai, and Guangdong all exceeding 2500 yuan.

Qiao Qingmei stated that residents' expectations of the rural pension system will also affect their choice of payment levels. Currently, many ordinary people do not have a deep understanding of the rural pension system and may worry that they will not be able to receive their pension in full and on time when they retire after decades of payment. In the future, local government departments still need to further strengthen publicity and promotion in this regard.

Subsidy policy shifts, car market sales decline for three consecutive months

HSBC reports that gold prices may hit the $5000 mark in the first half of the year, with market expectations that silver prices will continue to rise

How can Herm ? s in the mobile phone case industry make young people rush to buy it?