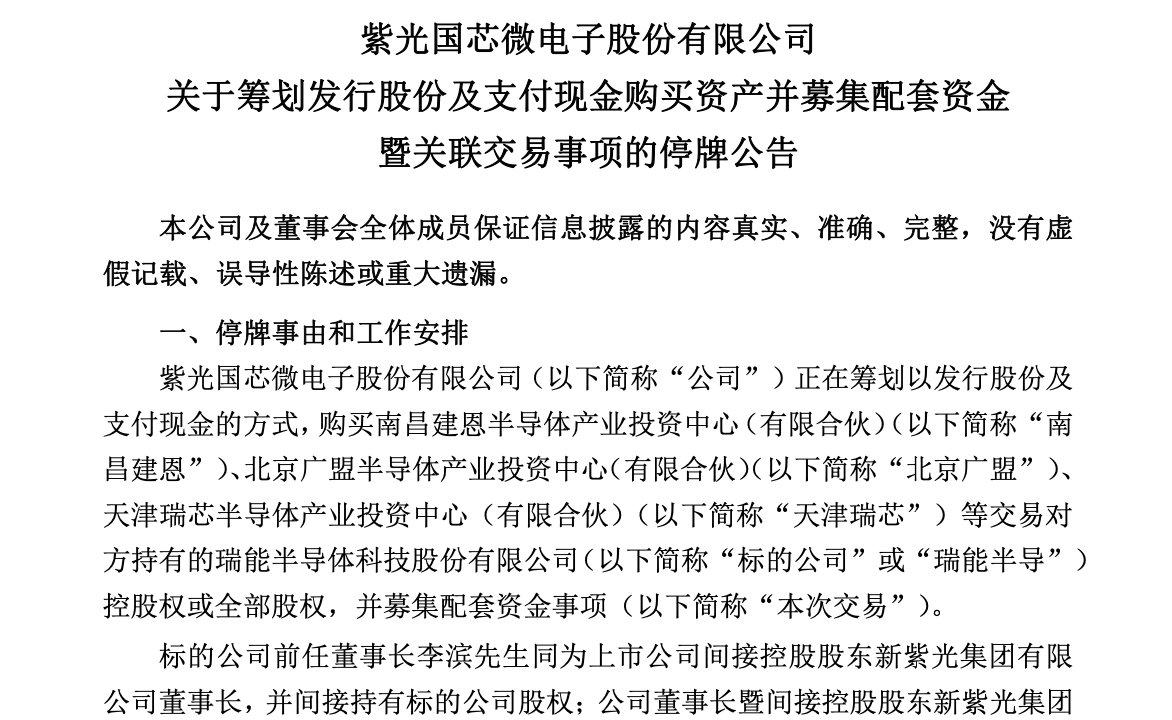

As 2025 is coming to an end, a notice from Ziguang Guowei (002049. SZ), a subsidiary of New Ziguang Group, has brought to light the most eye-catching merger and acquisition in the semiconductor industry at the end of the year.

On the evening of December 29th, Ziguang Guowei announced that it is planning to purchase the controlling stake or all equity of Ruineng Semiconductor Technology Co., Ltd. (hereinafter referred to as "Ruineng Semiconductor") held by counterparties such as Nanchang Jianen Semiconductor Industry Investment Center (Limited Partnership) (hereinafter referred to as "Nanchang Jianen"), Beijing Guangmeng Semiconductor Industry Investment Center (Limited Partnership) (hereinafter referred to as "Beijing Guangmeng"), Tianjin Ruixin Semiconductor Industry Investment Center (Limited Partnership) (hereinafter referred to as "Tianjin Ruixin") through issuing shares and paying cash.

The two protagonists of this merger are heavyweight companies in the semiconductor industry. Ziguang Guowei is one of the main comprehensive integrated circuit listed companies in China, with main businesses covering special integrated circuits, intelligent security chips, etc., while Ruineng Semiconductor has launched the "famous brand" NXP, which is still a global leader in automotive electronics. At the same time,The identity of "Made in China" by Ruineng Semiconductor also makes it a key link in building an independent and controllable semiconductor industry chain?

Deeply cultivating power semiconductors for 55 years, leading multiple tracks

Founded in 2015, Rui Neng Semiconductor can be traced back to Philips' semiconductor power device division in 1969. In 2006, the division operated independently and was officially renamed NXP. In August 2015, NXP and a fund under Beijing Jianguang Asset Management Co., Ltd. jointly invested to establish Rui Neng Semiconductor. This "new" company also continues the pioneer's 55 year development history in the field of power semiconductors.

Power semiconductor is a special category of semiconductor devices mainly used for processing high voltage and high current, realizing the conversion, control, and management of electrical energy. Unlike ordinary semiconductors such as integrated circuits used for signal processing and logic operations, power semiconductors are designed specifically for power electronics applications. Their core functions generally include converting AC and DC electricity to each other, adjusting voltage, frequency, or phase, as well as achieving power amplification, line protection, and efficient switching operations.

In 2019, NXP completely withdrew its holdings,Ruineng Semiconductor has become a 100% Chinese owned enterpriseAfterwards, the company continued to expand production capacity and increase research and development investment, expanding its product line to include silicon carbide devices, thyristor rectifiers, power diodes, TVS/ESD, IGBT and modules, which are widely used in consumer electronics, industrial and big data, renewable energy and automotive electronics fields.

Long term deep cultivation in the power semiconductor field has accumulated rich customer resources and sales network for Ruineng. In the consumer electronics field, its customers include Dyson, Whirlpool, Electrolux, Gree, Midea, and Haier; Customers in the industrial sector include Delta, Schneider, and others. According to the official website of Ruineng, the company has established 15 sales offices worldwide, providing services to over 8000 customers worldwide.This international sales and customer network not only ensures the company's deep penetration into the global market, but also significantly leads most domestic power semiconductor companies in overseas order acquisition and brand influenceThis leading position further strengthens Ruineng's competitive advantage in cross-border cooperation and technological iteration.

The competition in the semiconductor industry is not just about technical parameters, but also about research and development thickness, mass production experience, and understanding of customer needs. Since its establishment 10 years ago, Ruineng Semiconductor has not only inherited NXP's mature process platform, quality system, and customer resources, but also continuously expanded its product line to meet downstream demands.

The development of industries such as renewable energy, electric vehicles, and artificial intelligence has also provided a broad market space for Ruineng Semiconductor to expand its product line. According to relevant articles on the official WeChat account of Ruineng, before 2015, the product categories of Ruineng Semiconductor were mainly focused on three aspects: thyristors, power diodes, and high-voltage transistors,But in recent years, the company has continuously focused on the development of emerging fields and expanded its product line on a large scale?

In terms of thyristors, Ruineng Semiconductor has developed high-voltage thyristors and thyristor module products from traditional medium and low voltage thyristors. In terms of diode products, Ruineng Semiconductor has gone from ordinary fast recovery diodes to high-voltage fast recovery diodes, rectifier diodes, electrostatic protection diodes, and silicon carbide diodes. Especially for silicon carbide products, currently silicon carbide diodes are mainly concentrated in the 5th and 6th generation products, among which the 6th generation silicon carbide diode technology level is consistent with international first-line brands.

Compared to the previous generation of silicon carbide diodes, the technology of Ruineng Semiconductor's sixth generation silicon carbide diodes can reduce conduction loss by about 25% at a high temperature of 150 degrees; In terms of system efficiency, the sixth generation technology can improve system efficiency by about 0.2%. This also means that a 20KW charging station using the sixth generation silicon carbide of Ruineng can save about 350 kWh of electricity compared to the previous generation product in one year.

According to Omdia's latest report in 2021, Ruineng Semiconductor currently ranks first among Chinese brands of thyristors and second globally; Ranked first domestically and fifth globally in silicon carbide rectifiers.

Continuously expanding the automotive electronics landscape, a key link in the independently controllable industry chain

Ruineng Semiconductor not only has a process platform, quality system, and customer resources inherited from NXP, but as a semiconductor enterprise wholly owned by Chinese capital, Ruineng has also become a key link in the independent and controllable semiconductor supply chain. As an A-share listed company controlled by the New Ziguang Group, Ziguang Guowei's main business covers special integrated circuits and intelligent security chip business. In recent years, it has focused on expanding into automotive electronics. Against this backdrop, if it can successfully merge with Ruineng Semiconductor, it will obtain rare assets in the industry.

In recent years, silicon carbide devices have been widely used in fields such as inverters and car chargers due to their high temperature and high voltage resistance characteristics. This is also an important direction for the layout of Ruineng Semiconductor in the automotive electronics field. According to the official WeChat account of Ruineng Semiconductor, in July 2023, the company invested approximately 200 million yuan to establish a wholly-owned Jinshan module factory in the Shanghai Bay Area High tech Zone, which will be put into operation. The factory mainly produces and applies various types of power module products, including new energy and automotive fields.

In addition, silicon carbide modules are entering the aerospace and defense fields that require extremely high reliability, size, and weight. These modules are used for power converters, radar systems, and electric propulsion systems in drones and aircraft, ushering in a new era of innovation in these key areas.

If we look at the entire industry chain and supply chain, the "independent and controllable" characteristics of Ruineng Semiconductor are believed to be a key factor in Ziguang Guowei's acquisition decision.

Ruineng Semiconductor adopts the vertical integration mode of IDM, which has its own wafer manufacturing and packaging testing capabilities,Although it originated from NXP, it has already achieved complete localizationA complete R&D and manufacturing system has been established domestically, making the supply chain safer and more controllable. Ruineng Semiconductor is currently not only100% owned by Chinese capital, currently the company's two major wafer fabs in Jilin and Beijing, as well as packaging module factories, are all located within China?

Not long ago, there was a control dispute and disturbance to the supply chain surrounding Anshi Semiconductor, which has not been fully resolved yet. Anshi Semiconductor products are also widely used in the automotive, industrial, and consumer electronics fields. In contrast, Rui Neng Semiconductor, which is completely "made in China", will not face similar control and supply chain risks, and its integration into the listed company system will also promote more open and transparent operations.

It is worth noting that Ruineng Semiconductor has taken advantage of Ziguang Guowei to enter the capital market, and shareholders Fang Zhilu Jianguang and New Ziguang Group have clearly played a pivotal role in this process. Analysts have pointed out that,Ziguang Guowei and Ruineng Semiconductor are not only a strong alliance, but also a complementary business map?

Based on the development trend of the capital market, the China Securities Regulatory Commission (CSRC) announced in September 2024Six Articles on Mergers and Acquisitions(i.e. Opinions on Deepening the Market Reform of Mergers and Acquisitions of Listed Companies)The introduction of this policy has had significant effects on activating the capital market and improving the efficiency of mergers and acquisitions. Numerous listed companies have also been able to inject high-quality assets with high technological content and strong development potentialAccording to statistics, in 2025, the number of A-share first-time disclosed share issuance and asset purchase transactions reached 134, nearly doubling compared to listing. Under the "six mergers and acquisitions" plan, in addition to Ruineng Semiconductor, a series of high-quality companies in the semiconductor field invested by Zhilu Jianguang are also expected to merge into Ziguang Guowei in the future.

According to publicly available information, Zhilu Jianguang has also invested in non listed assets in the semiconductor field, including Ampleon Semiconductor, Sun Moon New Group (formerly known as Sun Moon's four packaging and testing factories in mainland China), United Technologies of Singapore (UTAC), Advanced Packaging Materials Company (AAMI), and others. Analysts have pointed out that if the relevant assets follow the path of Ruineng Semiconductor and merge into Ziguang Guowei or other listed companies in the future, it will further expand its coverage in the semiconductor industry chain and enhance the comprehensive competitiveness of the relevant companies in the A-share market and the enterprise itself.

Subsidy policy shifts, car market sales decline for three consecutive months

HSBC reports that gold prices may hit the $5000 mark in the first half of the year, with market expectations that silver prices will continue to rise

How can Herm ? s in the mobile phone case industry make young people rush to buy it?